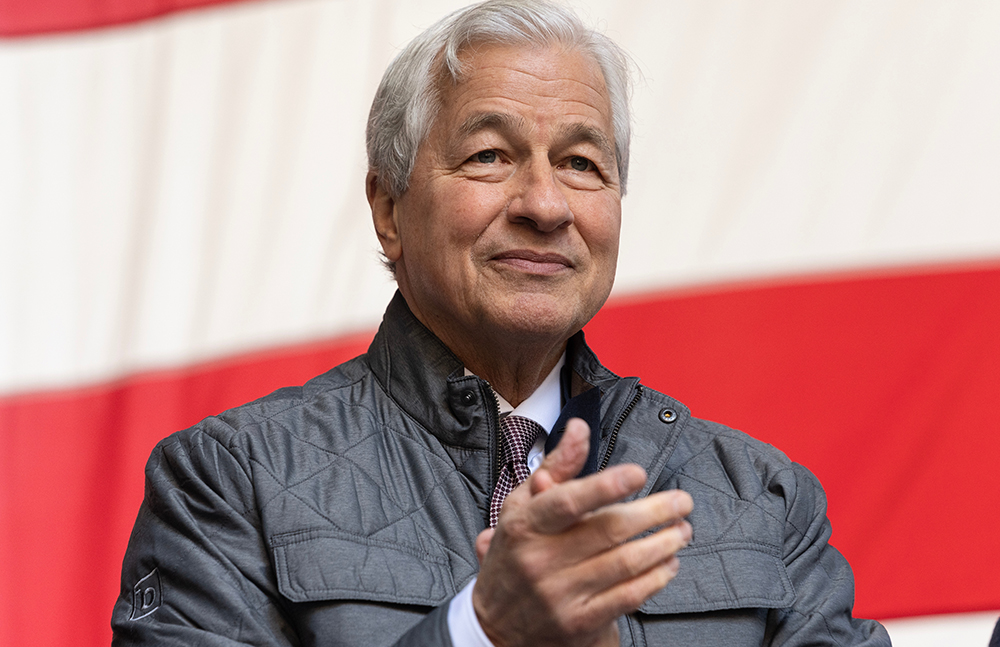

Jamie Dimon, CEO of JPMorgan Chase, said Thursday the market is likely to be thrown into panic when the U.S. approaches a sovereign debt default. Dimon told Bloomberg in a televised interview that an actual default would be “potentially catastrophic” for the country. Dimon said he expects the worst-case scenario will be avoided, however, because lawmakers will be forced to respond to growing concerns. “The closer you get to it, you will have panic” in the form of stock market volatility and upheaval in Treasurys, he said. Dimon joined a host of business figures and administration officials in making dire predictions about the consequences of failing to raise or suspend the U.S. debt limit. This would allow the world’s largest economy to default on its bonds. Treasury Secretary Janet Yellen has said the default idea is “unthinkable” and would lead to economic disaster. “If it gets to that panic point, people have to react, we’ve seen that before,” Dimon said. But “it’s a really bad idea, because panic becomes something that is not good,” he added. “It could affect other markets around the world.”

According to Dimon, Morgan, with approximately $3.7 trillion in assets, has been preparing for the possibility of an American default. Such an event would ripple through the financial world, impacting “contracts, collateral, clearing houses, and affect clients definitely around the world,” he said. According to him, the bank’s war room already meets once weekly, but it will move to daily meetings around May 21 and then to three meetings a day afterward. He exhorted politicians from both major U.S. parties to compromise and avoid a ruinous outcome. “Please negotiate a deal,” Dimon said.