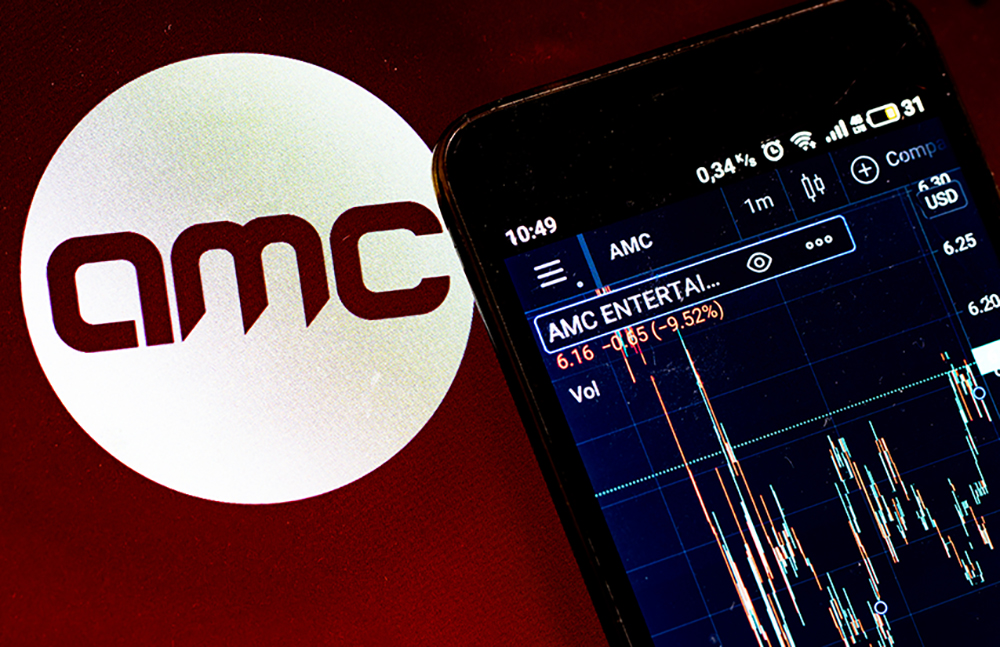

AMC Entertainment witnessed a sharp drop of over 20% in its share price, reaching a new 52-week low of $2.46 per share. This decline is in anticipation of a stock conversion scheduled for later in the week. On Friday, the company’s preferred equity units, APE shares, are set to be transformed into common stock, a year after their introduction on the New York Stock Exchange. The APE shares were designed to enable AMC to issue more stock while appeasing investors concerned about dilution, who rejected the company’s attempts to issue additional shares last year. During the COVID-19 pandemic, AMC raised significant funds by selling new stock, aiding in debt repayment, and preventing bankruptcy while theaters faced closures or limited screenings. In addition to the stock conversion, AMC plans a reverse stock split of 10-to-1 on Thursday. This maneuver increases the company’s authorized share count from 52.5 million to 550 million, permitting AMC to issue more than 390 million shares.

This complex share reconfiguration follows a lawsuit in February that accused AMC of manipulating a shareholder vote related to the conversion of preferred stock to common stock and the issuance of new shares. The revised stockholder settlement was recently approved by a Delaware judge. The downward trajectory of AMC’s shares can be attributed to concerns about the company potentially issuing a substantial amount of equity to address its debt balance. Analysts, including Eric Wold of B. Riley Securities, recognize the necessity of additional liquidity for AMC’s immediate future, especially considering projections that the company won’t achieve positive free cash flow until 2025. While Eric Wold believes that AMC’s stock conversion is a strategy to navigate the film exhibition industry’s post-pandemic recovery and ongoing issues in Hollywood, Roth MKM’s Eric Handler holds a more pessimistic view. Handler’s valuation assessment suggests AMC’s shares are trading at an irrational level, considering the need for significant adjusted EBITDA figures to justify the current market capitalization. Despite the differing perspectives, the imminent stock conversion will impact AMC’s financial landscape, offering a potential solution to immediate liquidity concerns and drawing attention to the complexities and challenges the company faces in its recovery.